October 21, 2024

While retirement might seem like a distant horizon for many of us, understanding Social Security now can set us up for a more secure future. One lesser-known aspect of Social Security is the “payback option” – a strategy that could potentially boost your benefits down the line. What is the Social Security Payback Option? The payback option, sometimes called the...

Read NOW

October 7, 2024

10 Tips to Protect Your Retirement Savings from Inflation

Inflation is often called the “silent thief” of retirement savings. It can erode the purchasing power of your money over time, potentially derailing even the most carefully laid retirement plans. But do not worry – there are strategies you can employ to help safeguard your nest egg from the effects of inflation. How Does Inflation Impact My Retirement? Before diving...

Read NOW

September 30, 2024

Fiduciary Financial Advisors: Help Secure Your Financial Future with Trustworthy Expertise

When it comes to managing your finances and planning for the future, finding the right guidance is crucial. You may have heard the term “fiduciary financial advisor” and wondered what it means, why it matters, and how to find a fiduciary financial advisor near you. Not all financial advisors are the same. Some provide higher levels of service, expertise, and...

Read NOW

September 17, 2024

401(k) to IRA Rollover Guide: Maximize Your Retirement Savings

401K Rollover to IRA Rules There are two types of rollovers: direct rollovers and indirect rollovers. In a direct rollover, the funds from your 401(k) are transmitted directly to the new retirement plan. There are no withdrawal fees or distributions to the participant, making this the most hands-off rollover method. An indirect rollover is where the funds from your 401(k)...

Read NOW

September 10, 2024

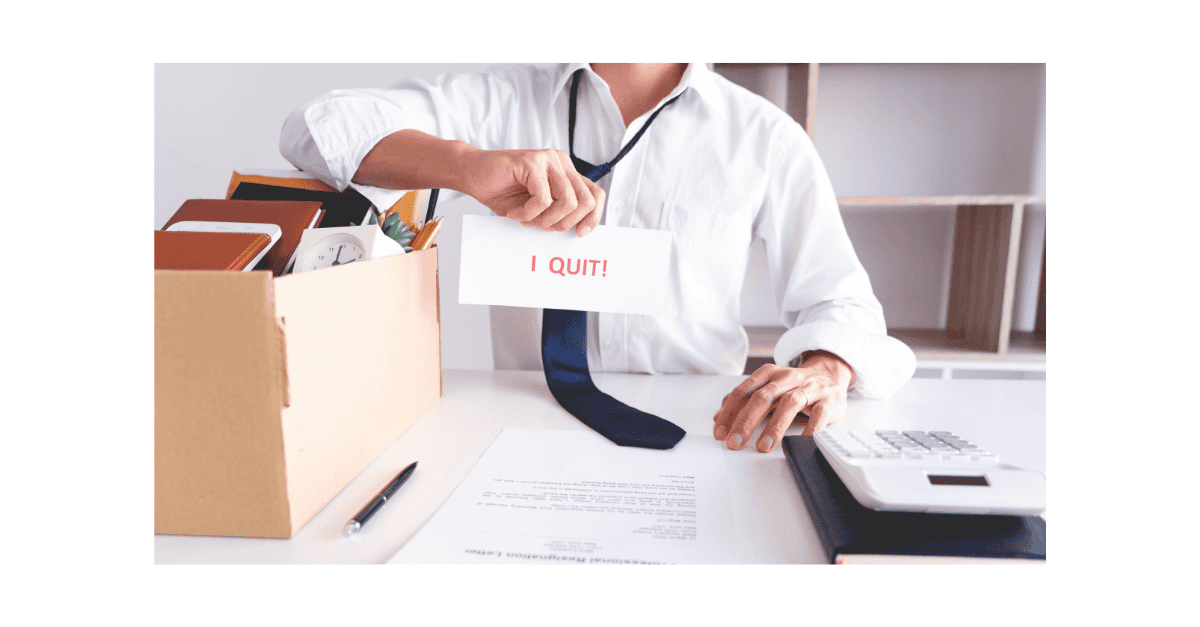

401(k) Rollover Guide: Best Options for Your Old Retirement

What Are My 401(K) Rollover Options? When an employee leaves their job, they have to decide what to do with their old 401(k) retirement account. There are five common options you can consider that include: When Would I Want to Leave My Old 401(k) with My Former Employer? Leaving your old 401(K) account with your former employer is the easiest...

Read NOW

August 20, 2024

What Happens to a 401(K) When You Quit?

When an employee separates service from an employer with a 401(k), they must determine what to do with the retirement account. With the stress of change, sometimes determining what to do with your group retirement plan falls to the wayside. Adding on top having to figure out the options, it can be easier to try and ignore your account, than...

Read NOW

June 24, 2024

How To Choose the Right Investments for Retirement

Making important decisions about investment strategies in advance of retirement will guarantee growth and stability of funds throughout your post-retirement years. With correct planning, your nest egg can be maintained, and even grown, to ensure a comfortable retirement income and offer you the ability to take care of loved ones after you’ve left the workplace. With so many investment options...

Read NOW

May 7, 2024

How Much Money Do I Need to Retire?

Understanding how much money you need to retire is one of the biggest questions we get from our clients, and it is one question we find they do not think about soon enough, or often enough. It is a question that lacks a one-size-fits-all answer, as the ideal retirement savings can vary greatly depending on individual circumstances, lifestyle choices, and...

Read NOW

April 26, 2024

Is $1 Million Enough to Retire?

Planning for retirement is a significant financial milestone for many individuals. Among the many questions that arise during this planning phase, perhaps one of the most common is, “How far can $1 million take me in retirement?” While $1 million might sound like a substantial sum, its purchasing power in retirement can vary widely depending on factors such as: 4...

Read NOW

January 29, 2024

Maximize Your Savings: Understanding 2024’s New Higher IRA and 401(k) Contribution Limits

In the ever-evolving financial landscape of retirement savings and tax provisions, 2024 brings promising news for individuals planning for their future. The annual adjustments due to the cost of living have ushered in increased contribution limits for IRAs and 401(k) plans, offering enhanced opportunities for individuals to bolster their retirement funds. What are the 2024 IRA Contribution Limits? Last year...

Read NOW